Guided Wealth Management - The Facts

Table of ContentsTop Guidelines Of Guided Wealth ManagementThe Basic Principles Of Guided Wealth Management Guided Wealth Management - The FactsLittle Known Facts About Guided Wealth Management.5 Simple Techniques For Guided Wealth Management

For more pointers, see keep an eye on your financial investments. For financial investments, make payments payable to the product supplier (not your adviser) (retirement planning brisbane). Regularly inspect deals if you have an investment account or use an financial investment platform. Giving a financial advisor complete access to your account enhances danger. If you see anything that does not look right, there are actions you can take.If you're paying a recurring suggestions cost, your advisor ought to review your monetary circumstance and fulfill with you at the very least annually. At this meeting, ensure you go over: any kind of changes to your goals, scenario or funds (including changes to your income, expenses or possessions) whether the degree of risk you're comfortable with has actually altered whether your current personal insurance policy cover is best just how you're tracking against your goals whether any kind of modifications to laws or financial products might impact you whether you have actually obtained everything they assured in your arrangement with them whether you need any type of changes to your plan Yearly an advisor need to seek your created grant bill you ongoing guidance fees.

This might happen throughout the meeting or online. When you enter or renew the recurring fee plan with your adviser, they need to define just how to end your relationship with them. If you're transferring to a brand-new advisor, you'll need to set up to move your economic records to them. If you need help, ask your consultant to clarify the process.

The smart Trick of Guided Wealth Management That Nobody is Discussing

As a business owner or local business owner, you have a great deal taking place. There are several obligations and expenses in running an organization and you definitely don't need one more unneeded bill to pay. You require to thoroughly think about the roi of any solutions you get to ensure they are beneficial to you and your organization.

If you are just one of them, you may be taking a huge threat for the future of your business and on your own. You may intend to keep reading for a list of reasons that hiring a monetary advisor is advantageous to you and your business. Running a service has plenty of obstacles.

Cash mismanagement, cash money flow troubles, delinquent payments, tax obligation concerns and other economic issues can be vital adequate to close a business down. There are several means that a certified financial expert can be your companion in helping your organization grow.

They can collaborate with you in examining your monetary situation regularly to prevent serious errors and to quickly deal with any type of poor money choices. A lot of tiny service proprietors put on several hats. It's reasonable that you desire to conserve money by doing some tasks yourself, however managing funds takes expertise and training.

Things about Guided Wealth Management

You need it to understand where you're going, just how you're getting there, and what to do if there are bumps in the road. A good economic consultant can put with each other a detailed plan to help you run your service a lot more effectively and prepare for anomalies that occur.

A trusted and well-informed financial consultant can direct you on the financial investments that are best for your service. Cash Cost savings Although you'll be paying a financial expert, the lasting cost savings will certainly justify the cost.

Decreased Anxiety As check this an organization owner, you have great deals of points to worry about. A good economic consultant can bring you tranquility of mind knowing that your funds are obtaining the interest they require and your money is being spent intelligently.

Guided Wealth Management - An Overview

Security and Development A competent monetary advisor can give you clearness and aid you concentrate on taking your business in the ideal direction. They have the tools and resources to employ methods that will certainly guarantee your organization grows and flourishes. They can aid you examine your objectives and determine the very best course to reach them.

Guided Wealth Management for Beginners

At Nolan Accountancy Facility, we give competence in all aspects of monetary preparation for tiny businesses. As a small company ourselves, we recognize the difficulties you face each day. Offer us a telephone call today to talk about how we can aid your company flourish and succeed.

Independent possession of the technique Independent control of the AFSL; and Independent compensation, from the client only, via a fixed buck cost. (https://leetcode.com/u/guidedwealthm/)

There are numerous benefits of a monetary planner, no matter of your circumstance. The objective of this blog site is to prove why every person can benefit from an economic plan. financial advice brisbane.

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Brian Bonsall Then & Now!

Brian Bonsall Then & Now! Michelle Pfeiffer Then & Now!

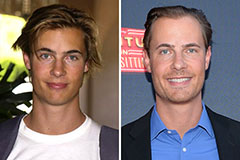

Michelle Pfeiffer Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now!