A Comprehensive Overview to How Credit Score Fixing Can Change Your Credit Report

Comprehending the details of debt repair service is vital for anybody seeking to enhance their monetary standing. By attending to concerns such as payment history and credit report utilization, people can take positive steps toward improving their credit score ratings.

Understanding Credit History

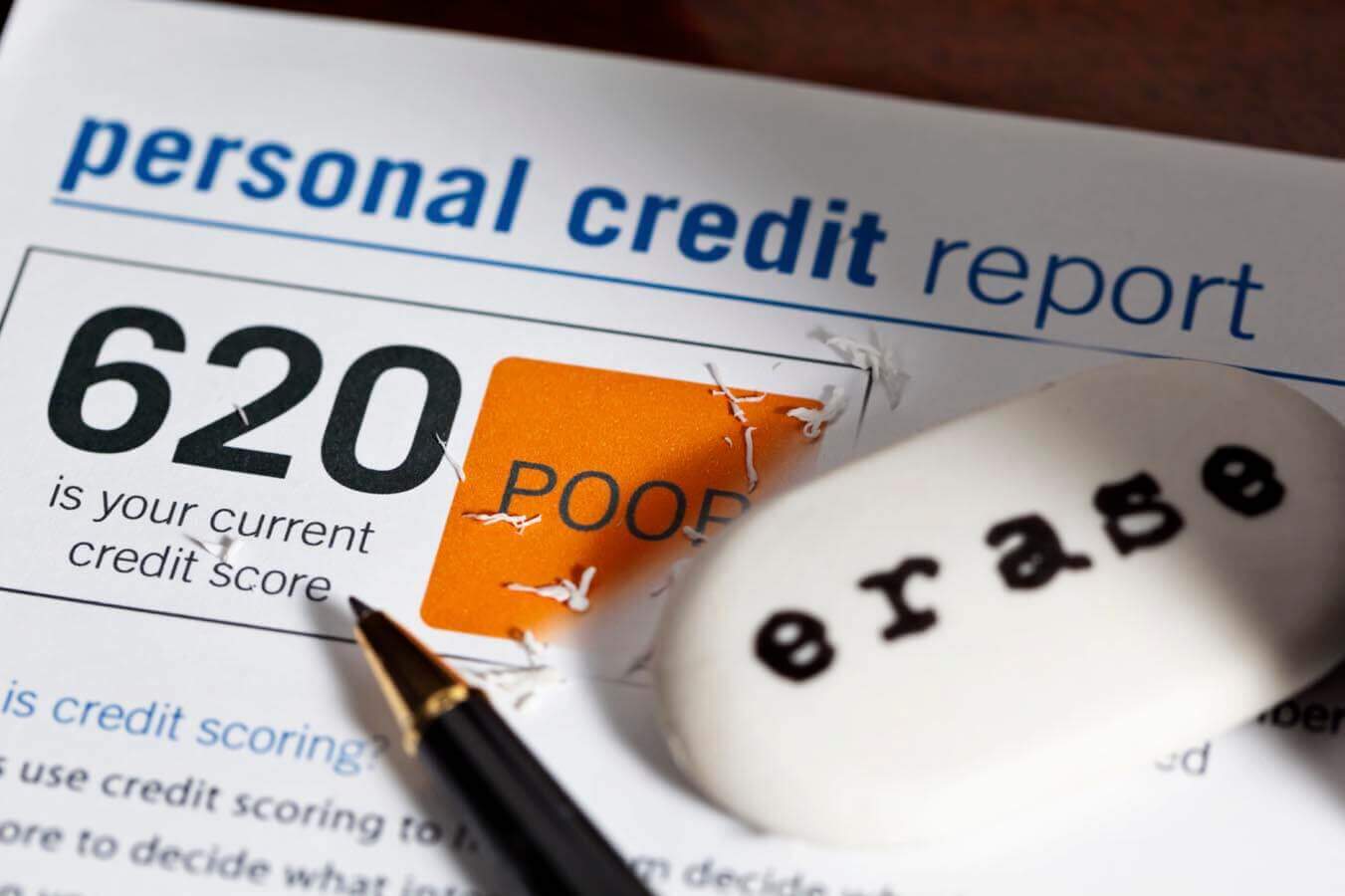

Understanding credit rating is vital for anyone looking for to boost their financial health and accessibility much better loaning choices. A credit report is a numerical depiction of a person's creditworthiness, generally ranging from 300 to 850. This rating is created based upon the details consisted of in a person's credit score record, which includes their credit rating, outstanding debts, repayment background, and kinds of credit report accounts.

Lenders utilize credit history to evaluate the danger connected with providing cash or prolonging credit score. Greater scores show lower danger, typically resulting in much more positive finance terms, such as reduced rate of interest and higher credit line. Conversely, reduced credit report can cause greater passion prices or denial of credit score entirely.

Several factors affect credit history, including settlement history, which represents roughly 35% of the rating, followed by credit score usage (30%), length of credit rating (15%), kinds of credit score being used (10%), and brand-new credit history questions (10%) Understanding these factors can empower individuals to take actionable steps to improve their scores, ultimately enhancing their economic opportunities and stability. Credit Repair.

Common Credit Scores Issues

Lots of individuals face common credit report issues that can hinder their financial development and influence their credit report. One widespread issue is late repayments, which can considerably damage credit report ratings. Also a solitary late repayment can continue to be on a credit history record for numerous years, influencing future borrowing potential.

Identification theft is another significant worry, potentially resulting in deceptive accounts appearing on one's credit record. Such situations can be testing to correct and may call for considerable initiative to clear one's name. Additionally, errors in credit score reports, whether due to clerical mistakes or outdated details, can misstate an individual's credit reliability. Attending to these common credit concerns is vital to enhancing economic health and establishing a solid credit scores profile.

The Credit Repair Work Refine

Although credit history repair work can seem overwhelming, it is a systematic procedure that individuals can undertake to enhance their credit report and rectify mistakes on their credit rating records. The very first step involves getting a duplicate of your credit history record from the three significant debt bureaus: Experian, TransUnion, and Equifax. Review these reports diligently for disparities or errors, such as incorrect account details or out-of-date info.

As soon as errors are determined, the next step is to dispute these mistakes. This can be done by contacting the credit report bureaus directly, supplying paperwork that sustains your claim. The bureaus are required to check out conflicts within 1 month.

Preserving a regular payment history and taking care of credit score use is likewise important during this process. Checking your credit rating regularly makes sure continuous accuracy and helps track enhancements over time, reinforcing the performance of your credit scores repair initiatives. Credit Repair.

Benefits of Credit Rating Repair Work

The advantages of credit scores repair service prolong much past merely boosting one's credit history; they can substantially influence monetary security and possibilities. By resolving mistakes and negative things on a credit score record, individuals can boost their credit reliability, making them much more eye-catching to lenders and banks. This enhancement usually causes far better rate of interest rates on financings, reduced premiums for insurance, and increased chances of approval for charge card and home loans.

Furthermore, credit history repair service can help with access to crucial services that require a credit address history check, such as renting a home or obtaining an energy solution. With a healthier credit rating account, people might experience boosted self-confidence in their economic choices, permitting them to make larger acquisitions or financial investments that were formerly unreachable.

Along with concrete economic advantages, credit score fixing cultivates a feeling of empowerment. Individuals take control of their monetary future by actively handling their credit scores, causing more informed choices and greater financial literacy. On the whole, the advantages of credit score fixing contribute to a more steady monetary landscape, inevitably advertising long-term economic development and individual success.

Selecting a Credit Rating Repair Service Solution

Choosing a credit rating repair work service requires mindful factor to consider to ensure that people obtain the assistance they require to boost their monetary standing. Begin by researching prospective companies, concentrating on those with positive customer reviews and a proven track document of success. Transparency is key; a trusted service should plainly outline their fees, processes, and timelines upfront.

Next, validate that the credit score repair work service abide by the Credit history Repair Organizations Act (CROA) This federal legislation shields consumers from misleading practices and collections guidelines for credit rating repair services. Stay clear of companies that make impractical promises, such as ensuring a details rating boost or declaring they can remove all negative products from your record.

Additionally, think about the level of consumer support supplied. A good credit history repair solution should offer tailored assistance, allowing you to ask questions and receive prompt updates on your progression. Seek services that offer a detailed evaluation of your debt record and establish a tailored method tailored to your particular scenario.

Eventually, choosing the best credit history repair work solution can bring about substantial improvements in your credit report, empowering you to take control of your financial future.

Final Thought

Finally, effective credit report fixing methods can significantly boost credit history by dealing with usual problems such as late payments and mistakes. A detailed understanding of credit report variables, integrated with the engagement of reputable credit scores repair service services, facilitates the arrangement of adverse products and continuous progression tracking. Eventually, the successful improvement of credit history ratings not just brings about much better loan terms however also cultivates greater financial chances and stability, emphasizing the relevance of positive credit history monitoring.

By addressing problems such as repayment history and debt utilization, people can take aggressive actions towards enhancing their credit rating scores.Lenders use credit scores to evaluate the danger linked with providing money or extending debt.An additional regular problem is high debt application, defined as the proportion of present credit score important link card balances to try this website overall readily available credit.Although credit scores repair work can seem overwhelming, it is a methodical procedure that people can carry out to improve their credit scores and rectify mistakes on their credit scores reports.Following, confirm that the credit history fixing solution complies with the Credit rating Fixing Organizations Act (CROA)